M&A Strategy Consulting

P&C Global’s M&A Strategy Consulting Services

In today’s high-stakes environment, M&A strategy consulting is essential for organizations seeking to drive growth, reshape portfolios, or gain competitive edge. Mergers and acquisitions consulting is no longer just about financial transactions—they are strategic inflection points that define market leadership, signal long-term intent, and demand flawless execution. As companies navigate technological disruption, geopolitical volatility, and rising investor scrutiny, a disciplined, insight-led M&A strategic planning approach is critical to turning ambition into sustained value.

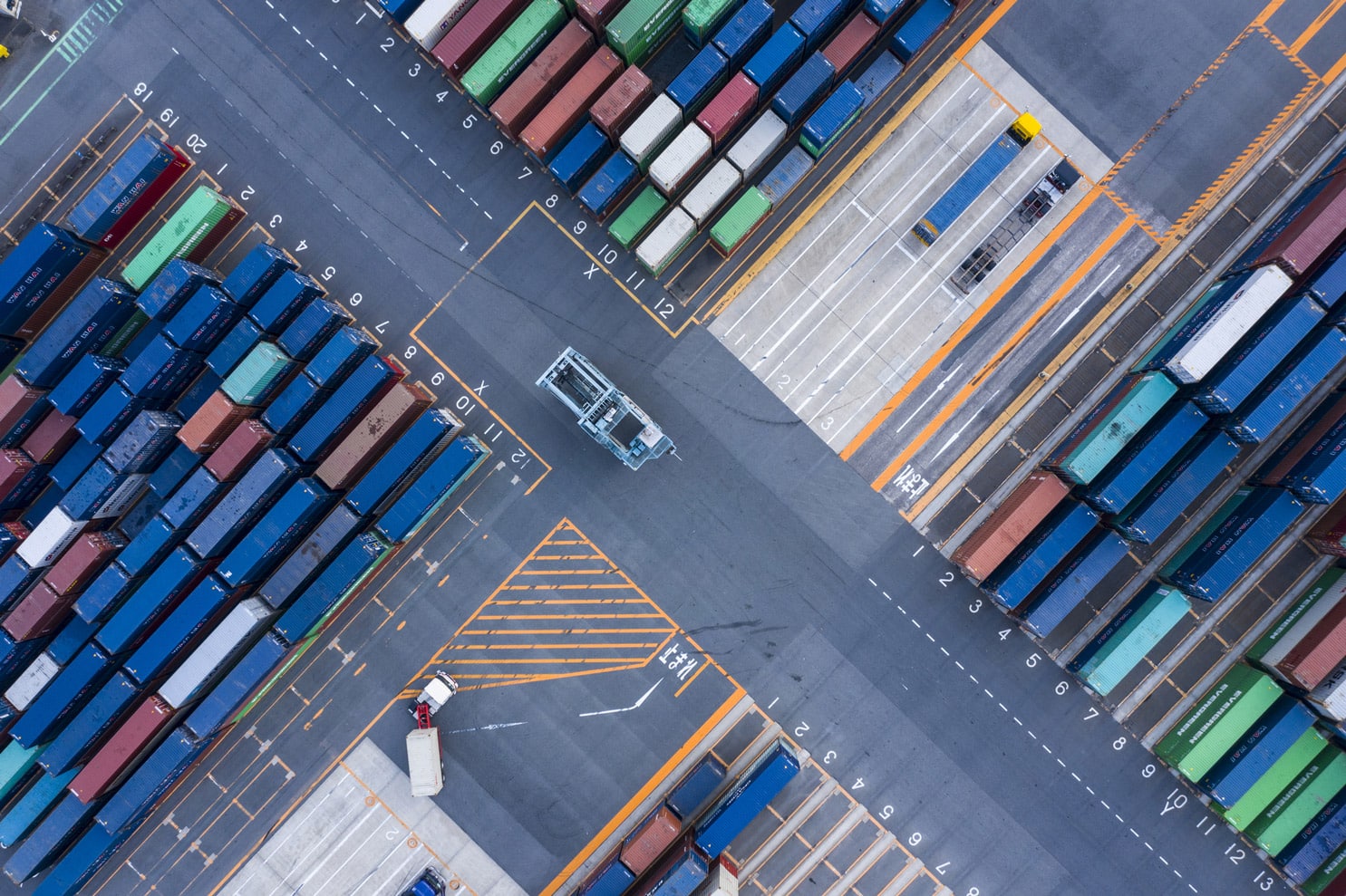

P&C Global’s M&A strategy consulting services are built to meet these demands head-on. Whether you are pursuing transformative acquisitions, buy-side M&A consulting, cross-border expansion, divestiture strategy, or joint ventures, we help your organization align ambition with execution. From deal sourcing and target identification to post-merger integration, our approach is rooted in data, driven by insight, and designed for impact. From commercial real estate and healthcare & life sciences to global logistics and luxury retail, we serve organizations seeking clarity in complexity, speed without sacrifice, and value beyond the deal through corporate M&A consulting.

Challenges Facing Industry Leaders

M&A remains one of the most powerful, but perilous, tools for business transformation. As organizations pursue bold moves to redefine portfolios, enter new markets, or acquire critical capabilities, the complexity behind each deal continues to grow. At P&C Global, our M&A strategy consultants experience reveals the structural, cultural, and operational barriers that often undermine deal success. The challenges that follow reflect why successful M&A demands more than intent—it requires strategy, precision, and executional discipline at every step.

Strategic Misalignment in Deal Objectives

Too often, M&A transactions are driven by opportunism rather than strategy. Without clear alignment to corporate development strategy—whether market expansion, portfolio rationalization, or capability acquisition—firms risk diluting value. In some cases, a lack of clear objectives around capital restructuring or asset rationalization exacerbates this misalignment. This challenge is especially acute in capital-intensive industries like manufacturing and commercial real estate, where deal structuring and strategic fit are critical.

Inadequate Diligence & Synergy Planning

Due diligence frequently focuses on financials while overlooking cultural integration, technology fit, and operational feasibility. This limited view leads to overestimating synergy analysis or underestimating integration costs, especially in sectors such as high-tech and financial services, where intangible assets and IP are central to value. Our M&A due diligence consulting ensures full-spectrum diligence—financial, operational, and cultural.

M&A Integration Delays & Execution Risk

A well-negotiated deal can falter in execution. For managing large workforces, regulatory requirements, and brand equity, integration timelines can quickly spiral. Missteps in change management in M&A, systems alignment, or talent retention can significantly erode anticipated returns. We mitigate these risks through tailored M&A integration services and rigorous execution planning.

Complex Regulatory & Market Volatility

Navigating cross-border M&A deals, antitrust scrutiny, and fluctuating valuations requires exceptional foresight. Law firms and global logistics companies operating across jurisdictions must factor in legal complexity, political risk, and trade barriers that may delay or derail transactions. Our team provides risk assessment in M&A to help clients anticipate and adapt to these dynamic variables.

Stakeholder Skepticism & Internal Resistance

In industries like luxury retail and high-tech, where brand identity and culture drive differentiation, M&A announcements often generate internal friction and external skepticism. Leaders must carefully manage communication, employee engagement, and market confidence to protect value. Our strategic investor support and corporate leadership alignment frameworks are designed to keep all stakeholders aligned and engaged.

Our Approach to Mergers & Acquisitions Strategy Consulting

As a trusted M&A strategy consulting firm, P&C Global approaches M&A not as a transaction, but as a strategic inflection point with lasting enterprise impact. Our mergers & acquisitions strategy consulting services are designed to guide organizations through the full transaction lifecycle—from opportunity framing to post-merger integration—with rigor, agility, and precision. We combine data-driven insight with hands-on execution to ensure each deal aligns with long-term goals, unlocks measurable value, and avoids the common pitfalls that derail even the most promising transactions.

Strategic Mergers & Acquisitions Deal Framing

We begin by anchoring each engagement in enterprise-wide strategic priorities. Our M&A strategy consultants work with your leadership to define the “why” behind the deal, identify value drivers, and align the transaction with long-term value creation strategy, business consolidation strategy, and growth objectives.

Market Intelligence & Target Screening

We leverage advanced analytics and proprietary industry insights to identify, assess, and prioritize acquisition or divestiture targets. We ensure strategic fit not only by size or financials, but by culture, capabilities, and synergetic potential—backed by competitive landscape analysis and sector-specific M&A expertise.

M&A Due Diligence & Risk Assessment

We apply a rigorous diligence framework that goes beyond traditional financial vetting. Our process includes financial modeling, technology audits, operational due diligence, talent assessments, brand impact analysis, and cultural compatibility reviews. As a strategic M&A advisory firm, we flag hidden risks before they become liabilities and align recommendations with your broader enterprise value optimization goals. We help clients model and validate revenue synergy realization opportunities to ensure targets are achievable and sustainable.

M&A Integration Planning & Execution

We bring a cross-functional lens to M&A execution support—aligning operating models, harmonizing systems, consolidating functions, and safeguarding human capital. Each integration plan is tailored, milestone-driven, and equipped with accountability metrics to ensure success in even the most complex business consolidation strategies.

Change Management & Communication

We recognize that M&A is as much a leadership challenge as it is a financial one. Through structured stakeholder engagement, internal communications strategy, and leadership alignment, we help organizations navigate the human complexities of each transaction with clarity, continuity, and confidence—supporting your team through CEO succession and M&A, executive M&A advisory, and enterprise-wide adoption.

Execution Management & Value Realization

We stay engaged post-close to ensure strategic realignment through acquisitions becomes measurable impact. Through performance tracking, escalation protocols, and steering routines, we help leadership teams course-correct in real time and maintain momentum. Our M&A execution management keeps value delivery on track—long after the deal is signed.

Outcomes Clients Can Expect

- Accelerated growth through M&A

- Improved deal discipline and M&A portfolio optimization

- Seamless integration of systems, talent, and culture

- Enhanced stakeholder trust and board-level M&A strategy

- Future-ready operating models and digital transformation through M&A

Why M&A Strategy Consulting Services Matters Now

In a marketplace defined by scale, speed, and reinvention, global M&A strategy consulting is no longer optional—it’s essential. The right deal can unlock competitive advantage, close capability gaps, and secure market leadership. But the margin for error has never been narrower. Now is the moment for disciplined, data-driven decision-making through business acquisition consultants who deliver real outcomes. P&C Global delivers M&A strategy advisory that is strategic in vision and operational in practice—designed to help you outperform in today’s market and outmaneuver in tomorrow’s.

Transform M&A Strategy & Results

P&C Global engages through trusted introductions and long-standing relationships to shape and execute M&A strategy with precision, resilience, and strategic clarity.

Frequently Asked Questions — M&A Strategy Advisory

P&C Global does more than deliver PowerPoint strategies—we deliver realized value. We embed strategic rigor with execution accountability, ensuring every engagement moves from design to measurable impact.

Our operator-led teams, former CEOs, CFOs, and integration leaders, design and execute end-to-end M&A strategies that create synergy, not just model it. We fuse strategic foresight with operational precision, ensuring every transaction achieves cultural alignment, accelerated integration, and sustained competitive advantage.

Powered by quantum-enabled diligence and advanced analytics, we help clients identify smarter targets, execute with confidence, and capture full post-deal value.

True M&A success lies in alignment, not just arithmetic. P&C Global integrates strategic fit, cultural cohesion, and execution readiness into every deal model. Our operator-led teams design transactions that not only expand capacity but amplify performance, turning combined entities into unified, agile growth engines that outperform their separate parts.

We apply a disciplined, multi-dimensional targeting framework backed by AI and behavioral insight. P&C Global assesses targets via strategic fit, client overlap, financial viability, integration complexity, technology, and cultural alignment. Our Visage™ analytics engine surfaces acquisition candidates using market signals and synergy modeling. Then, we stress-test scenarios and craft go/no-go decision models customized to each organization’s strategic, operational, and market dynamics.

We embed integration design from day zero and own the execution. P&C Global leads integration planning, governance sequencing, talent alignment, and systems consolidation while managing risk, communication, and performance. Our operator-led teams remain on the ground to oversee delivery, enforce accountability, and measure performance across all synergy levers. Unlike firms that hand off execution, we stay engaged until the combined entity achieves its projected value and sustainable post-deal performance.

P&C Global applies predictive insight—not retrospective analysis—to every M&A engagement. Using advanced AI and data analytics, we model synergy potential, cross-sell opportunities, and integration friction before deals close. This forward-looking intelligence enables precision in valuation, accelerates post-merger integration, and maximizes realized synergies. Our analytics capabilities transform M&A from assumption-driven to evidence-based, allowing clients to capture value faster and with greater certainty.

Our measure of success is realized value, not projected potential. P&C Global ensures every transaction delivers tangible, verifiable results—from accelerated revenue growth and synergy capture to stronger client retention and organizational cohesion. Each engagement is anchored to defined KPIs and tracked beyond closing to confirm impact. We don’t declare success at signing —we stay until integration, performance, and value creation are proven and sustained. Explore client outcomes from leading enterprises worldwide in our Resource Center.

Not at all. Many of our highest-stakes M&A engagements are confidential by design. Whether it’s carve-outs, roll-ups, distressed deals, or international expansions, P&C Global crafts bespoke strategies that rarely appear in public listings due to their sensitivity. Senior decision-makers are invited to contact us directly for a private, secure discussion about tailored solutions aligned with their strategic and transactional objectives.

More in Strategy & Innovation

Success Stories

A dynamic showcase of P&C Global’s transformative engagements and the latest industry trends.

Demonstrated Outcomes. Significant Influence.

Witness the remarkable achievements we’ve enabled for ambitious clients.